May 2023 Retail Landscape

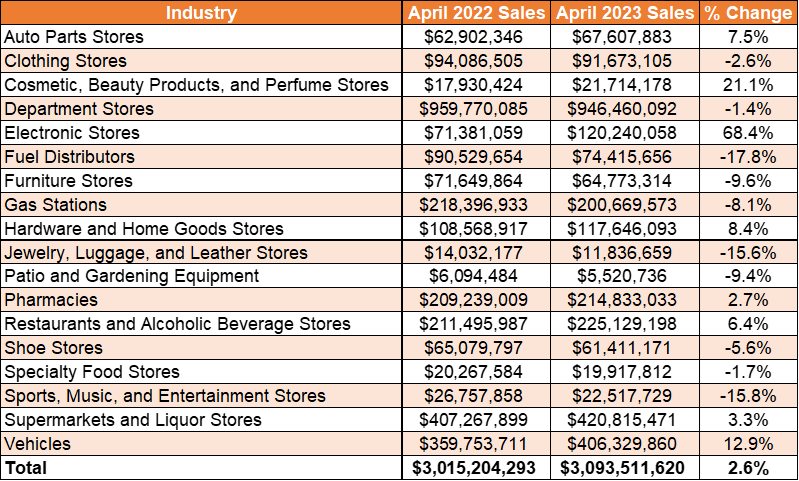

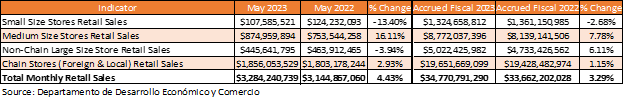

12 months agoRetail sales provide us with a snapshot of consumer spending and how the changes in consumer spending affect the different industries in the retail sector. When observing the recent month of May 2023 when compared year over year with May 2022 shows nominal growth in sales for 14 of the 18 industry categories, which totaled $3.3 billion in sales and in percentage terms reflected a 4.4% growth.

However, when observing the amount accrued for the 2023 fiscal year and comparing it to the 2022 fiscal year 13 of the 18 industry categories showed nominal growth in sales, having a total sales amount of $34.8 billion and a percentile growth of 3.3%. These values indicate that nominally consumers are comfortable with their current economic situation and are willing to continue to spend on retail products.

However, retail sales are composed of numerous industries, and studying growths or reduction patterns in sales helps determine consumer preferences.

Comparing the May 2023 values year over year revealed that electronic article stores experienced a considerable 23% increase in sales. In monetary terms this industry saw a $25.2 million growth, reaching the amount of $134.8 million that currently forms 4.1% of the total retail sales. In the amount accrued for the ongoing 2023 fiscal year electronic article electronic article stores also were the sector with the greatest growth to the amount of 18.1%. In monetary terms this sector saw a $168.3 million growth, reaching the amount of $1.1 billion that currently forms 3.2% of the total retail sales.

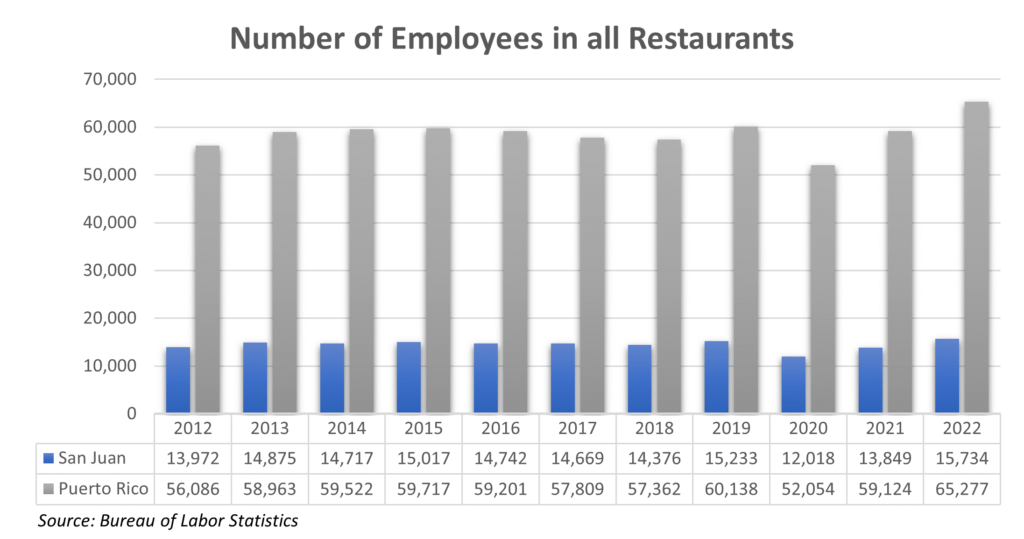

Another industry that presented significant growth in the ongoing fiscal year were restaurants and alcoholic beverage places. This industry while not demonstrating much growth for the month of May at 7.1%, it maintained a notable $236.6 million or 11.3% growth for the ongoing 2023 fiscal year. Additionally, the sales amount accrued by restaurants and alcoholic beverage places for the fiscal year was $2.3 billion, making it the sixth industry category in terms of sales and maintaining 6.2% of the total retail sales.

Conversely some sectors saw a major reduction in their sales during these observed periods, chiefly among these was the sporting goods, musical instruments, and entertainment industries. Not only did the sporting goods, musical instruments, and entertainment industries have reduced sales in May 2023 by 23.2%, but these industries also saw a 13.1% reduction in sales for the ongoing 2023 fiscal year.

These results demonstrate a surge in consumer spending towards electronic articles and restaurants, while simultaneously reducing spending towards sporting goods, musical instruments, and entertainment.

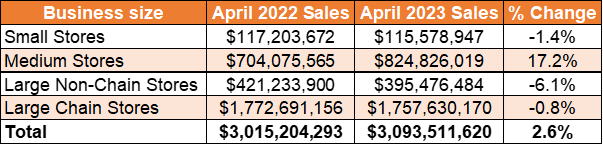

When these industries are examined according to their size, small and medium businesses (SMBs) maintained the highest level of growth for the month of May as well as the ongoing fiscal year. Sales from SMBs increased by 11.9% to reach $982.5 million for the month of May. When looking at the fiscal year, however, the growth was slightly reduced at 6.3% with $10.1 billion in sales for the period.

On the other hand, large establishments while they do compose the majority of total sales (70%), have experienced a slower growth compared to SMBs. Large establishment sales of $2.3 billion in May 2023 was only a 1.5% increase from the previous year’s sales, additionally the $24.7 billion accrued for the 2023 fiscal year only represented a 2.1% growth compared to the 2022 fiscal year.

These values indicate that SMBs continue to slowly capture market share from their larger sized competitors, even though large businesses do continue to demonstrate growth in sales, albeit to a lesser extent.

In conclusion, the retail performance in Puerto Rico shows positive signs towards consumer behavior. Most notably the majority of industries experienced nominal growth for not only the month of May, but also for the ongoing fiscal year as well. The consumer behavior demonstrated over different periods also aids businesses understand which industries are experiencing growth or reduction in sales and adjust their strategies accordingly.