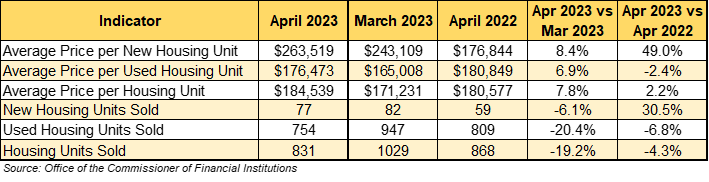

This April 2023 there was a total of 831 units sold for all categories, representing a 4.3% decrease from April 2022 and an even greater decrease of 19.2% when compared to the previous month of March 2023. The price per housing unit on the other hand has maintained itself rather consistent for the most recent months, averaging approximately $184,539 per unit this is a 2.2% increase compared to April 2022 and a larger increase of 7.8% when compared to March 2023.

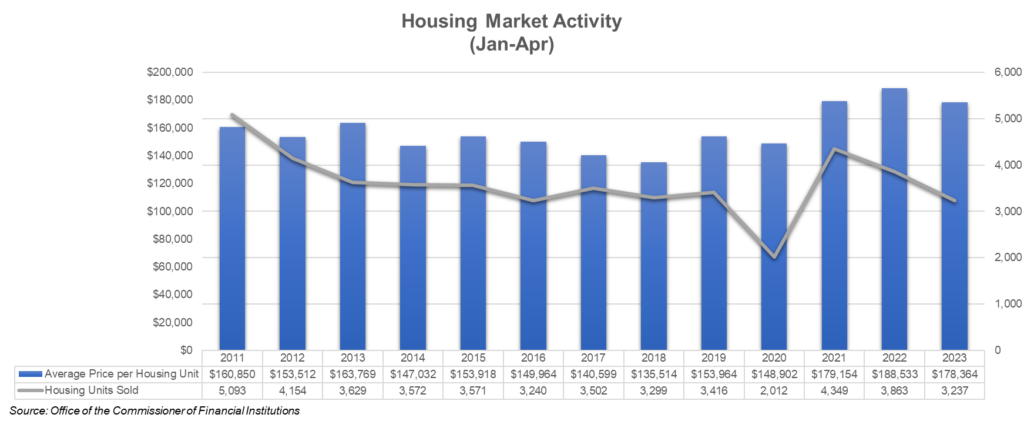

However, to see a more accurate measure of the real estate market performance compared to the previous years, the first trimester from January to April was grouped for each year to capture a greater number of observations. When analyzing these group values the trends observed with April 2023 of decreases in sales and maintained housing unit values were further reinforced for the 2023 period.

Housing unit sales for the current 2023 trimester reached 3,237 units sold, the second lowest value since 2011, including the 2020 pandemic period which maintains the lowest recorded housing unit sales for a period. As for the average price per household, the $151,014 on average that persisted through 2011-2020 increased post-pandemic by 21% to $182,017 along the 2021-2023 period, indicating the April 2023 value of $184,539 continues with the elevated values for the period which are expected to endure from multiple possible factors such as inflation and housing unit availability to name a few.

Overall, while housing values have maintained since being reinforced in 2021 the activity found within the market has been cooling down. The inverse situation to the 2020 boom can be said to be currently occurring with interest rates being raised from the minimal 0-0.25% ongoing since March 2020 making mortgages more affordable, now being raised to combat inflation starting March 2022 and having its most recent change in May 2023 where it currently stands at 5-5.25%. Now while that is not only one factor affecting the housing market, nevertheless it is a prominent feature and appears to illustrate the ongoing trends in the market appropriately.