The economic landscape of Puerto Rico has witnessed notable shifts in the manufacturing and construction sectors, with significant changes observed in the numerical indicators. By examining the specific figures and their variations from one year to another, we can gain valuable insights into the performance of these industries and identify opportunities for future growth.

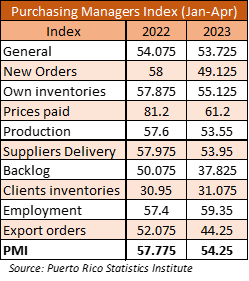

Within the manufacturing sector, there was a marginal decline in the Purchasing Managers General Index, from an average of 54.08 in 2022 to 53.73 in 2023. Although this dip may raise concerns, it is essential to consider the broader context in which these numbers emerge. The sector has demonstrated commendable resilience, recovering from the aftermath of previous challenges, such as natural disasters and economic downturns.

Diving deeper into the Purchasing Managers Index, we observe fluctuations in critical areas. New orders and production levels experienced a decline, with the average decreasing from 58 in 2022 to 49.13 in 2023. This shift highlights the manufacturing sector’s efforts to adapt to changing market dynamics and meet the demand amidst external disruptions. However, it is worth noting that despite these challenges, employment levels remained relatively stable, underscoring the sector’s contribution to overall economic stability.

As well as the PMI, other indicators within the manufacturing sector also exhibit intriguing trends. Backlogs and export orders witnessed a hefty decrease. The average backlog decreased from 50.08 in 2022 to 37.83 in 2023, indicating a shift in demand and potential challenges in meeting order fulfillment. Additionally, export orders declined, with the average dropping from 52.08 in 2022 to 44.25 in 2023. These variations reflect the changing international demand and supply chain disruptions, underscoring the need for adaptive strategies and diversification of markets.

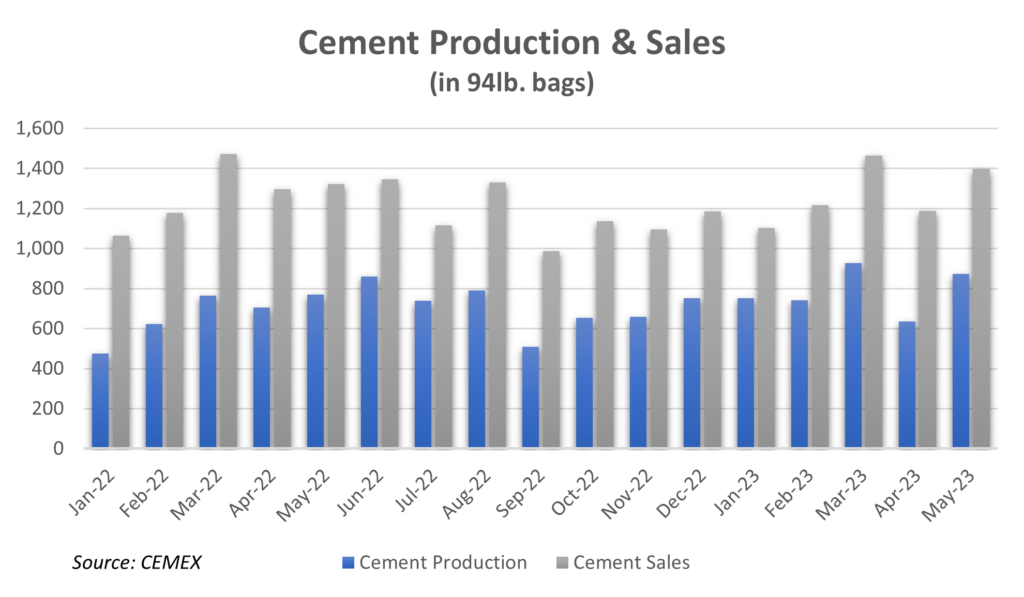

Turning our attention to the construction sector, the numbers tell a different story. Cement production witnessed a significant increase, soaring from an average of 667.5 (94lb. bags) in 2022 to 785.42 in 2023. This remarkable growth signifies a robust recovery in the construction industry. Despite the challenges faced, such as fluctuations in market demand and labor shortages, the sector has managed to capitalize on opportunities for infrastructure development and post-disaster reconstruction efforts.

Although cement sales experienced a slight increase, with average sales of 94lb. bags and bulk increasing from 1,266.04 in 2022 to 1,273.48 in 2023, it is important to note the overall sustained demand for construction materials. The construction sector has shown resilience in navigating the changing landscape, adapting to safety measures, and continuing its vital contributions to the economy.

To chart a path for sustained growth in both sectors, it is crucial to leverage the observed trends and identify areas of opportunity. Strengthening supply chains, fostering innovation, and investing in skilled labor will be pivotal in driving the manufacturing sector forward. Additionally, the construction sector can explore avenues for sustainable development, focusing on renewable energy projects, modern infrastructure, and eco-friendly building practices.

In conclusion, the numerical analysis of the manufacturing and construction sectors in Puerto Rico reveals a nuanced picture. While the manufacturing sector experienced a marginal decline in certain indicators, it demonstrated resilience and adaptability. On the other hand, the construction sector has witnessed significant growth, driven by post-disaster reconstruction and ongoing development projects. By harnessing these trends and implementing targeted strategies, Puerto Rico can position itself for sustained economic prosperity and contribute to the well-being of its citizens.