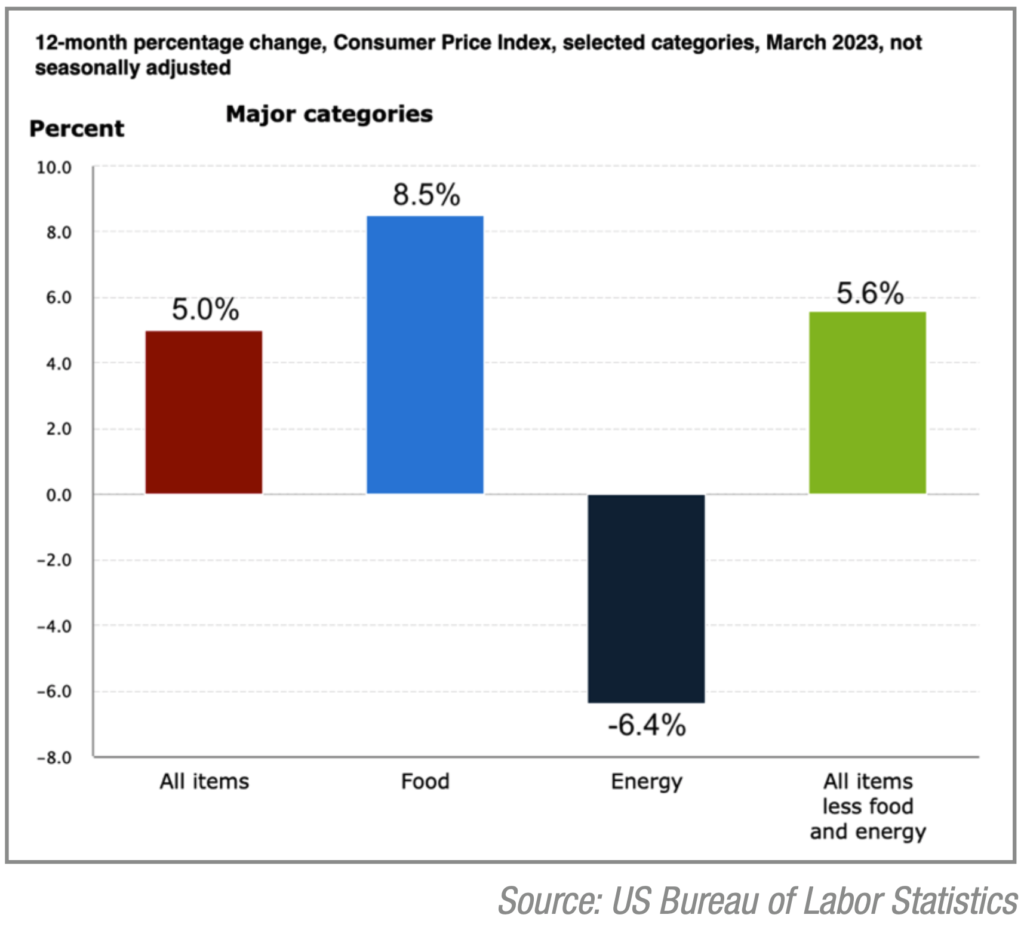

According to the Bureau of Labor Statistics, the CPI, which measures the price of a basket of goods and services, in the US for March 2023 reduced to 5%, the slowest pace for price increases since April 2021, when they first began to climb. This is two years of continued price increases above the average pre-pandemic numbers. In February 2023, the annual inflation figure stood at 6%, already a steep decline from its peak of 9.1% in June 2022.

Core inflation, which does not include volatile energy and food prices, for March 2023 was 5.6%, compared with February’s 5.5%.

Housing is the largest contributing factor to price increases over the last few months, rising 0.4% over the last month with an 8.2% rise over the last year. The uptick in housing prices offsets the impact that decreasing energy prices, which went down 6.4% over the last year, have had on the overall inflation rate.

Despite the overall cooling and inflation reduction the Federal Reserve will likely continue eyeing further interest rate hikes in their aggressive campaign to lower inflation. In March, the Fed increased rates by a quarter point to a range of 4.75% to 5%, a move largely seen as both assertive and conciliatory in the direct aftermath of the collapse of Silicon Valley Bank (SVB). The Fed has increased interest rates nine consecutive times over the last year, raising rates by a quarter point up to three-quarter points at a time.