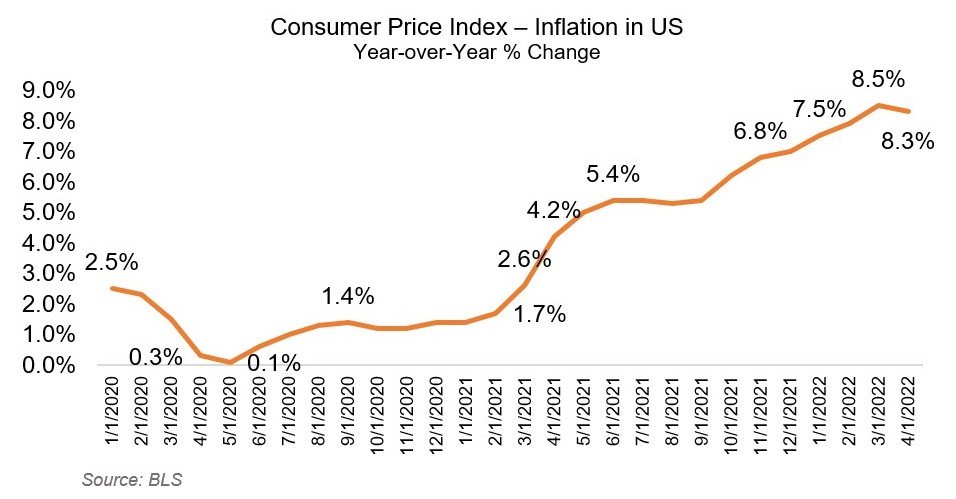

Inflation in the United States exceeds expectations and increases the pressure on the Fed for new increases in the interest rate. Consumer prices rose 0.3% in April compared to March and an accumulating rise of 8.3% compared to April 2021.

However, the data for April was above the 0.2% expected by the market for the month and the 8.1% forecast for the twelve months, according to a Bloomberg survey. This is worrisome since inflation beats market expectations and puts pressure on the Fed to act faster.

In addition, core inflation, which excludes food and energy prices, rose 0.6% in the month, thus exceeding the 0.4% expected by the market and doubling the 0.3% advance noted in March.

According to the Financial Times, “An underlying gauge of inflation also rose more than expected, highlighting stresses on American households and the challenge for the Biden administration. The data jolted the $22tn market for US government bonds, sending yields soaring. The two-year Treasury yield, which is most sensitive to the outlook for monetary policy, jumped at one point roughly 0.12 percentage points to 2.73%, before dropping back down to 2.67%. The benchmark 10-year note settled around 3% after rising rapidly as well. US stocks turned negative after the report.” This wasn’t expected by the Fed.

High inflation has led the Federal Reserve to accelerate the rise in interest rates. After an initial move of 0.25 points in March, the US central bank, for the first time since 2000, raised rates by half a point to the 0.75%-1% range at its last meeting on monetary policy. Its president, Jerome Powell, announced that he plans to raise them by another half percentage point at the June meeting and another 50 basis points at the July meeting.